Many people working in product development love to create cutting-edge tech, but can overlook the details involved with getting that tech to market. In this post, we will explore the commercial aspect of selling products, and how it can make the difference between success and failure.

Understanding Your Customer

A trap many people fall into is assuming that because their friends and colleagues think their product is a great idea and a good value, so will a potential customer. When you consider who will buy your product, it’s important to understand who the customer is and that they may be very different from you.

Let’s suppose you live in Seattle and work as a mechanical engineer. If your partner works as a firmware engineer, Glassdoor.com estimates that your household income would be around $185,000. This means that your household earns more than 93% of U.S. households. If you create a product for people like you, then your market would target only about 7% of U.S. households. If you plan on selling to the masses, keep in mind that the median U.S. household income is $55,000.

Sales Channels

Understanding the customer for each sales channel is critical. How compelling your product may be could be drastically different to each retailer’s customers.

Customers Average Household Income (7)

Dollar General: $44,972

Walmart: $53,125

Amazon: $58,000

Target: $65,125

Costco: $100,000 (8)

Power of Mass Market Retail

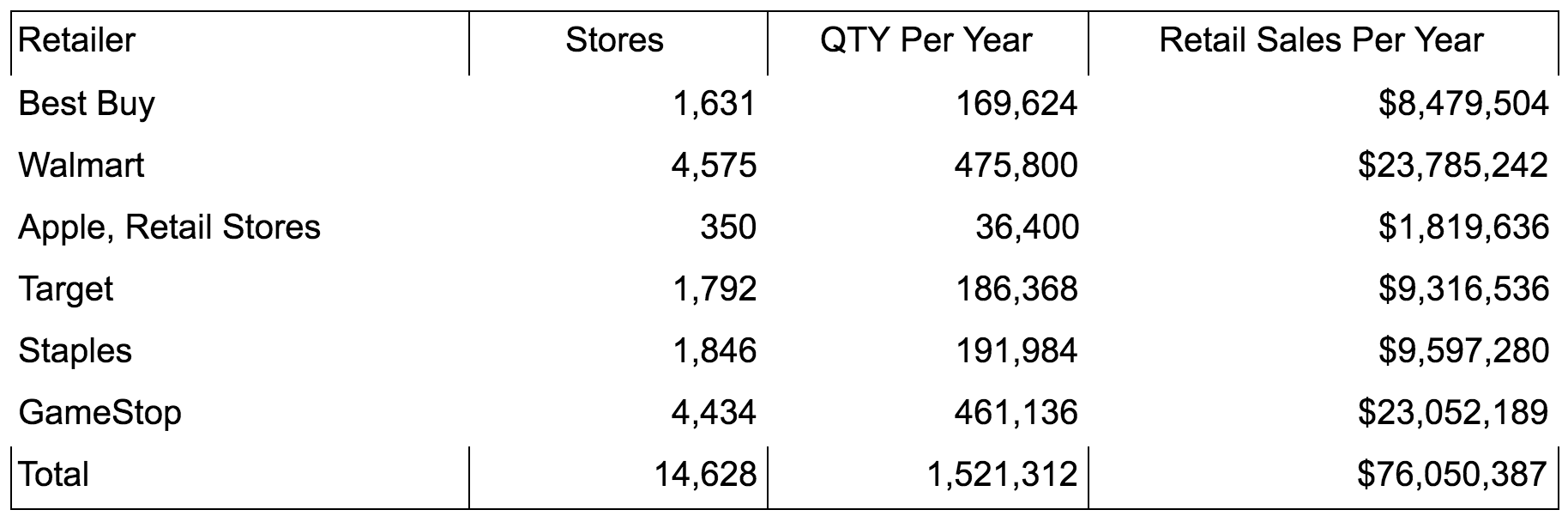

What’s all the fuss about mass market retail anyhow? To illustrate the power that mass market retail can have, we will use a consumer electronic device with an MSRP of $49.99 for our example. The numbers below show what it would look like if you were able to place this device at all of the top 10 U.S. consumer electronic brick and mortar retailers. In order to be successful, it needs to sell two units per store, per week. (To be clear, this is very rare. It’s more realistic to be able to place a new product at just 1-3 of these retailers!)

Margins and Retail Math

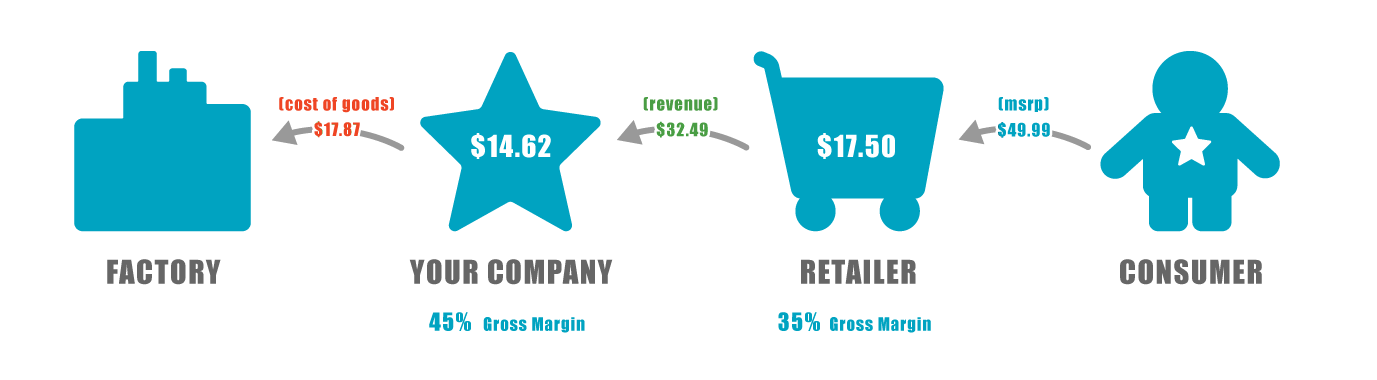

Every product category and retailer has different margin requirements, typically varying from 15-50% gross margin. In this example, our device has a $49.99 MSRP and we will assume that the retailers need a 35% gross margin and our product company needs 45% gross margins. Margin requirements for product companies vary from 15%-60%, but in general, 35% should be considered an absolute minimum for products that are closer to commodity. Cutting edge, innovative products that take significant research and development effort to bring to market usually have a gross margin of 50% or higher.

- The retailer will sell to the consumer for $49.99, making a $17.50 profit.

- The product company will sell to the retailer for $32.49, making a $14.62 profit.

- The product company needs to have the product manufactured for $17.87.

If the device were sold to Walmart, it would generate $23.8M at the register, with $15.6M gross sales for the product company and a $7M profit.

Cash Flow

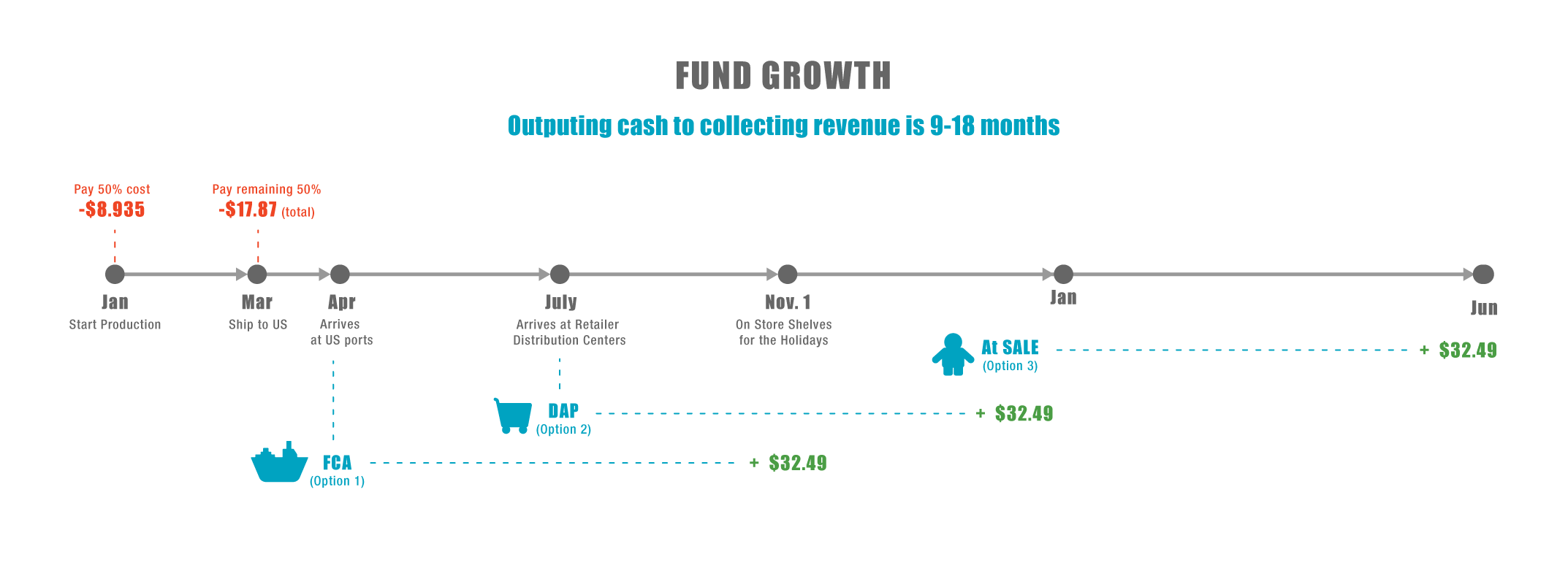

Cash Flow can kill an otherwise successful, growing company. Increasing sales is good, but it can create a cash flow problem, and cash is the lifeblood of a growing business. While many Kickstarters get the money that they need upfront, many of these companies don’t understand cash flow. For many startup businesses, having an investor is key to keeping your business afloat.

It’s important to think of cash flow in terms of time, not just dollars. Let’s look at an example order and see when cash is spent and when the company will typically be paid. Let’s assume that a retailer orders 50,000 units of our $49.99 MSRP device with terms FCA at a U.S. port. This means that your company is going to pay the manufacturer $1.1M for the product. Typical lead times are 60-90 days and you will likely have to pay some percentage up front for the manufacturer to order materials.

- January: 50% payment to the factory to order the materials (-$528,000).

- March: Remaining 50% due when the factory ships the product remaining for a total of (-$1,056,00).

- April: Typical transport time from the east coast of China to U.S. ports is 3-5 weeks.

- July – October: Every retailer and deal is different, but best case, payment is due when the retailers receive the product. The worst case is when they pay on scan and pay after the entire product order has sold! But, terms are always net 60 or more and you can expect payment to take 3-6 months! (+$1,624,500)

Using this example, for 6-12 months your company will have a cash flow issue… and that’s for a successful growing company! To support that growth, you’ll need to add staff to handle orders, launch new products, tool those products, pay employees, etc.

Summary

Understanding how your product will be sold can make the difference between financial success or failure. Every innovative product company needs cash to be able to hire talent and purchase equipment. Talk is cheap, but research is expensive. Your company has to make money in order to fund the research for your next device. Make sure you put your company in a place to be able to support a healthy and innovative product pipeline.

Learn more about Product Realization at Synapse

References

- ME Salary Seattle: https://www.glassdoor.com/Salaries/seattle-mechanical-engineer-salary-SRCH_IL.0,7_IM781_KO8,27.htm

- Firmware Salary: https://www.glassdoor.com/Salaries/seattle-firmware-engineer-salary-SRCH_IL.0,7_IM781_KO8,25.htm

- US CE market https://www.statista.com/statistics/272115/revenue-growth-ce-industry/

- US top CE retailers: https://www.statista.com/statistics/249788/sales-of-the-leading-10-consumer-electronics-retailers-of-the-us/

- Target Shopper Median household income: http://www.cbsnews.com/media/the-5-best-and-worst-things-to-buy-at-target/

- Walmart Customer: http://www.businessinsider.com/meet-the-average-wal-mart-shopper-2014-9

- http://www.businessinsider.com/dollar-store-shopper-demographics-2014-9

- http://www.cbsnews.com/media/12-things-about-costco-that-may-surprise-you/

- http://marketrealist.com/2015/01/best-buy-largest-consumer-electronics-retailer/